Sage Pastel - VAT Rate Change Guide - Manual Implementation

Date: 31 March 2018

Author: Coenraad de Beer

This guide is applicable to users of Sage Pastel Partner or Sage Pastel Xpress versions 12 and earlier, where it is necessary to make manual adjustments to Pastel in order to implement the new VAT rate of 15%, that will come into effect on 1 April 2018. Versions 14, 17 and 18 have a wizard that will automatically make the necessary adjustments.

Tax Rates Setup

The first step is to enter the expiry date of 31/03/18 for all of the 14% tax types. Click on Setup->Tax->General Settings. Click on the Percentages tab and change the End date for tax types 1, 4-10 as indicated in the screenshot below. This will prevent you from accidentally using the old tax codes.

Now scroll down to line 14 and enter the tax type descriptions, tax %, start dates and end dates as indicated in the screenshot below. Once you are done click on the OK button.

The Temp VAT rate can be used in instances where you need to make adjustments applicable to periods before 1 April 2018. Please consult with your accountant before using this tax type to ensure that it is used in compliance with VAT legislation.

Customer and Supplier Control

Once the tax percentages have been setup, you can set the defaults for your clients and suppliers. This will ensure that whenever you issue an invoice it will use the new 15% tax rate.

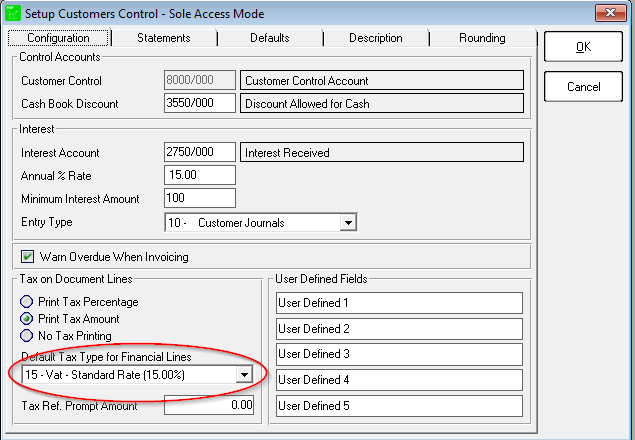

Click on Setup->Customers->Control and change the Default Tax Type for Financial Lines to the newly created tax type 15 as indicated in the screenshot below. Click on OK to apply the changes:

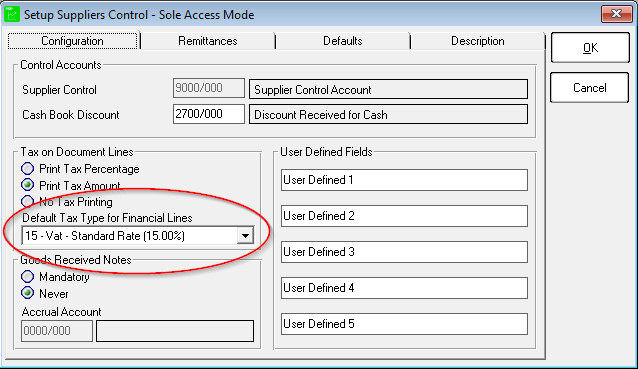

Repeat the same for your suppliers. Click on Setup->Suppliers->Control and make the necessary changes as indicated in the screenshot below. As before click on OK to apply the changes:

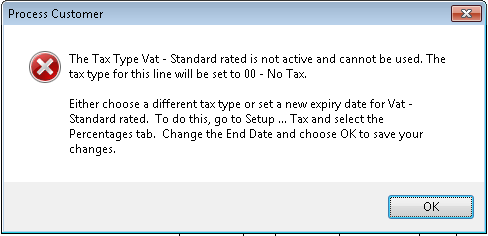

When you issue an invoice to a client you might get an error indicating that the tax type VAT - Standard rated is not active and cannot be used (see example below):

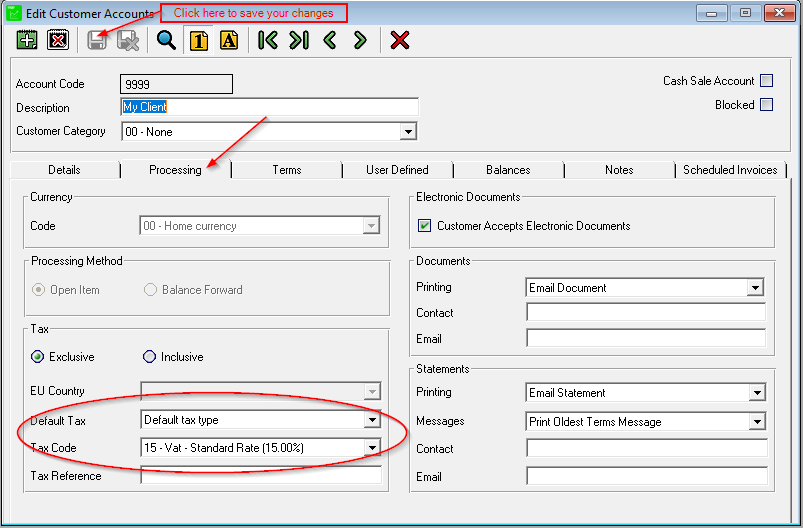

This occurs when Pastel wants to use the old 14% standard rate by default (because certain inventory items might still be set to 14%). You can easily change this to tax type 15, but this means you will have to do this for every line item on the invoice. To have Pastel default to 15% tax, go to Edit->Customers->Accounts click on Processing and make sure Default Tax is set to Default tax type and set the Tax Code to 15 - Vat Standard rated (15.00%) as illustrated in the screenshot below. NOTE: You need to repeat this process for every client. Remember to click on the save button before proceeding to the next client:

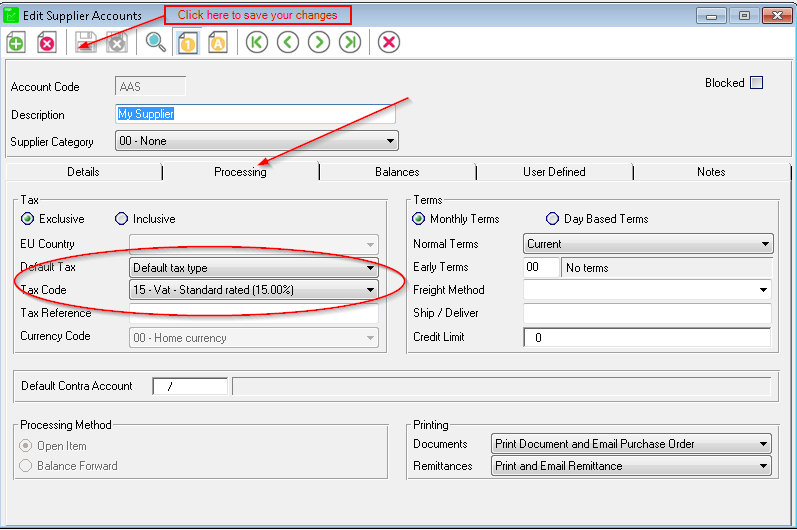

Repeat the same process for your suppliers (go to Edit->Suppliers->Accounts) as indicated in the screenshot below:

Inventory Control

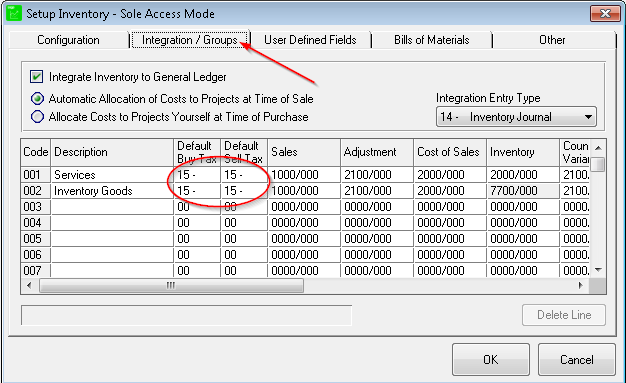

You also need to setup the default tax for your inventory items. First set the default tax for your inventory groups by clicking on Setup->Inventory and then click on the Integration / Groups tab. Set the Default Buy Tax and Default Sell Tax for all your groups to 15 as indicated in the screenshot below. As before click on OK to apply the changes:

The next part is the same tedious process as changing the default rates for all your clients and suppliers. However if you haven't set up standard prices for your inventory items and you enter the prices as you invoice, you can skip this step and proceed to the Tax Box Setup.

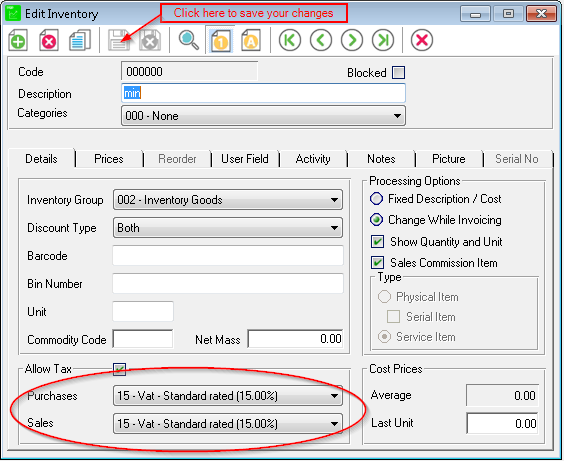

Click on Edit->Inventory->Item File and change the default tax rates for Sales and Purchases to 15 - Vat - Standard Rated (15.00%) as indicated in the screenshot below. Remember to click on the save button before proceeding to the next inventory item. You will have to repeat this step for all your inventory items.

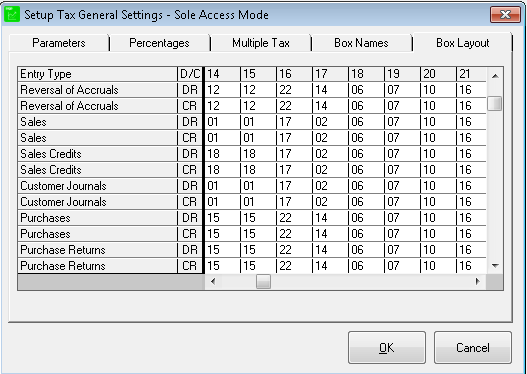

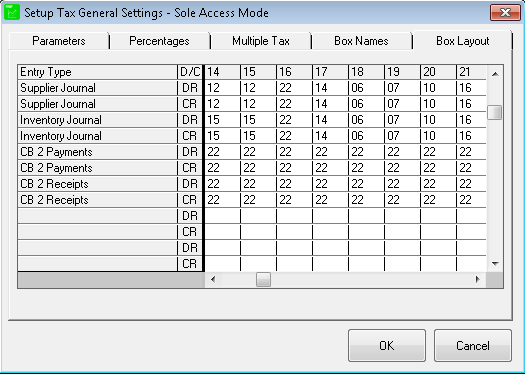

Tax Box Setup

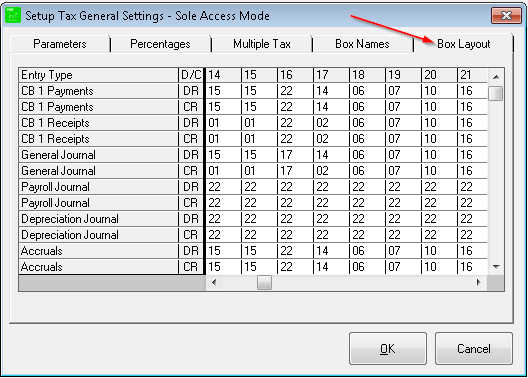

The final step of the VAT Rate change is the Tax Box setup. This needs to be done to pull the transactions under the new VAT rate through to your VAT reports.

Click on Setup->Tax->General Settings and click on the Box Layout tab. You will have to enter the applicable tax codes next to each entry type as indicated in the screenshots below. Please note that you may have more entry types as the ones illustrated below, but these are the basic entry types any set of Pastel Accounts should have:

This concludes the manual implementation of the VAT rate change. As mentioned at the beginning of this article, Sage Pastel versions 14 and up automatically makes these changes for you. Feel free to contact us if you would like to upgrade to the latest version of Pastel or if you require assistance with the implementation of the VAT rate change on Pastel.

Disclaimer:

The information and material published on this website is provided for general purposes only and does not constitute professional advice.

We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please contact us directly for any specific problem or matter.

We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages.

.png)